Ct State Tax Payments 2025

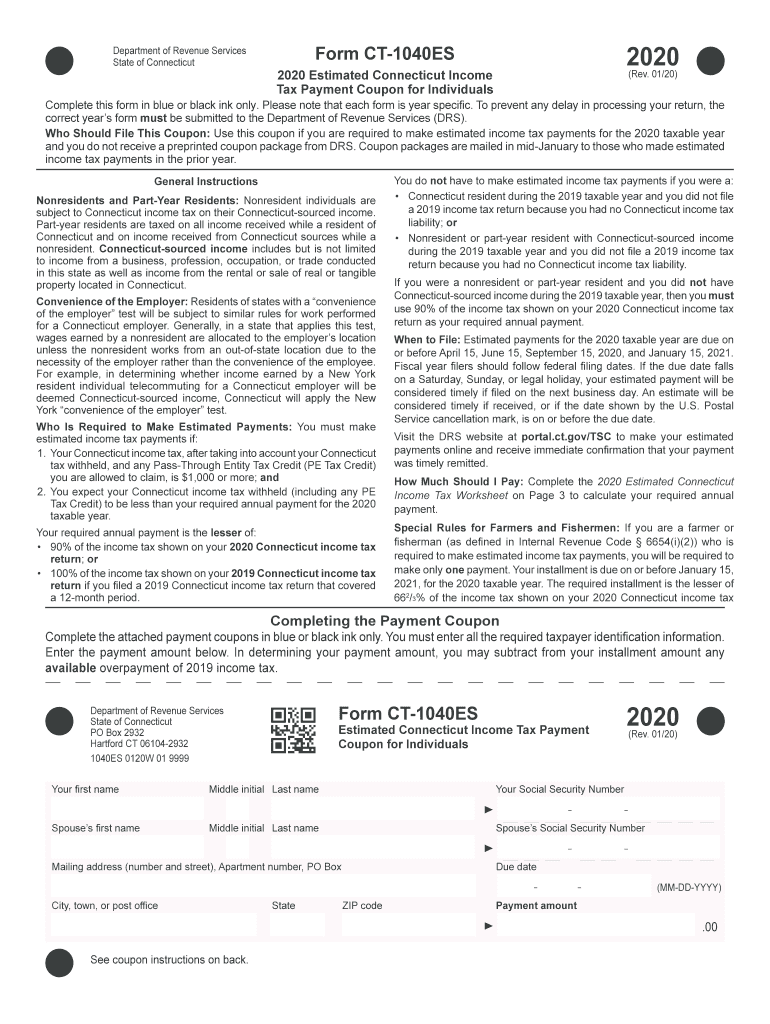

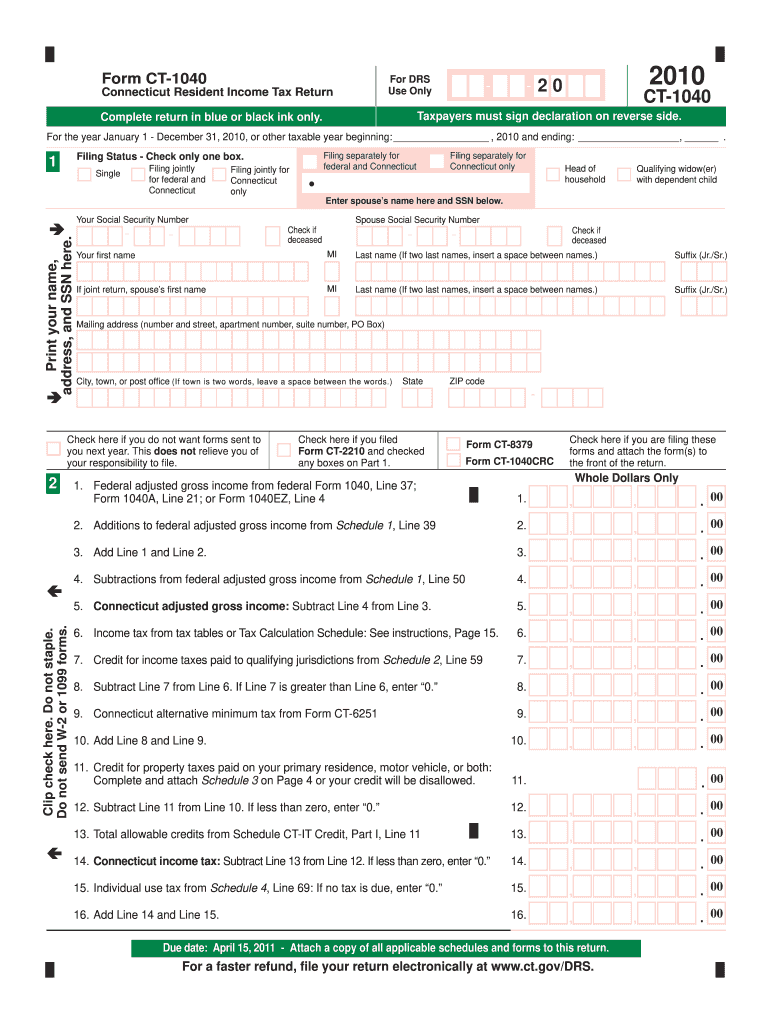

Ct State Tax Payments 2025 - Ct 1040 Form Fill Out and Sign Printable PDF Template signNow, Deduct the amount of tax paid from the tax calculation to provide an example. Enhancements to the child tax credit: State Of Ct Tax Tables For 2025 Rorie Claresta, To calculate your state of ct quarterly estimated tax payments, you must estimate your adjusted gross income, deductions, and credits for the calendar year 2025. The due dates for the estimated tax payments for the year 2025 are as follows:

Ct 1040 Form Fill Out and Sign Printable PDF Template signNow, Deduct the amount of tax paid from the tax calculation to provide an example. Enhancements to the child tax credit:

Connecticut Estimated Tax Payments 2025 Letty Olympie, To calculate your state of ct quarterly estimated tax payments, you must estimate your adjusted gross income, deductions, and credits for the calendar year 2025. By john moritz, staff writer dec 31, 2023.

Estimated Ct Tax Payments 2025 Timmy Giuditta, Benefits to electronic filing include: Estimate your tax liability based on your income, location and other conditions.

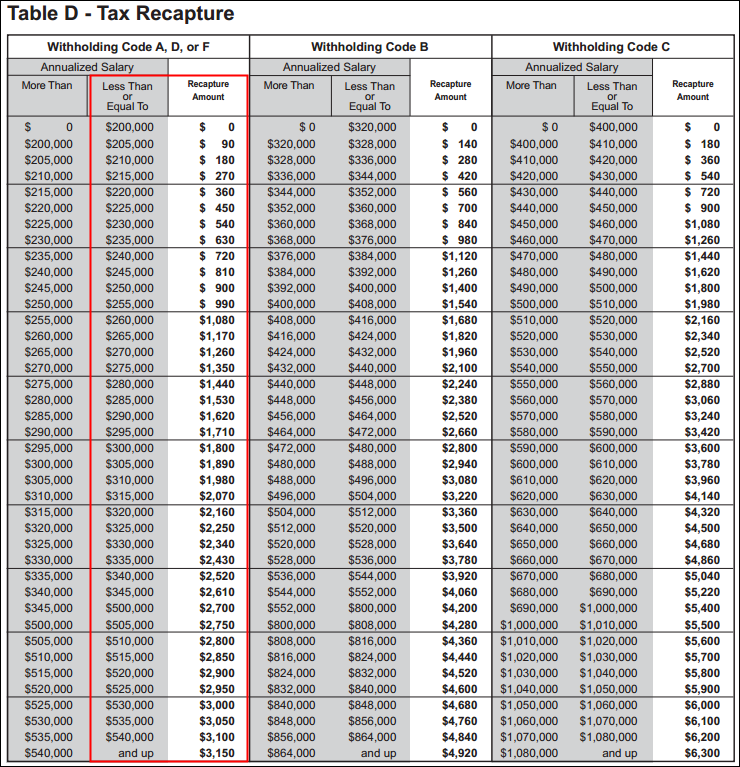

Use form ct‑1040es, estimated connecticut income tax payment coupon for individuals, to make estimated connecticut income tax payments for 2025 by mail. The 2025 tax rates and thresholds for both the connecticut state tax tables and federal tax tables are comprehensively integrated.

To calculate your state of ct quarterly estimated tax payments, you must estimate your adjusted gross income, deductions, and credits for the calendar year 2025.

Ct Tax Rates 2025 Dorie Geralda, Benefits to electronic filing include: If you made estimated tax payments by mail in 2023, you will automatically receive coupons for the.

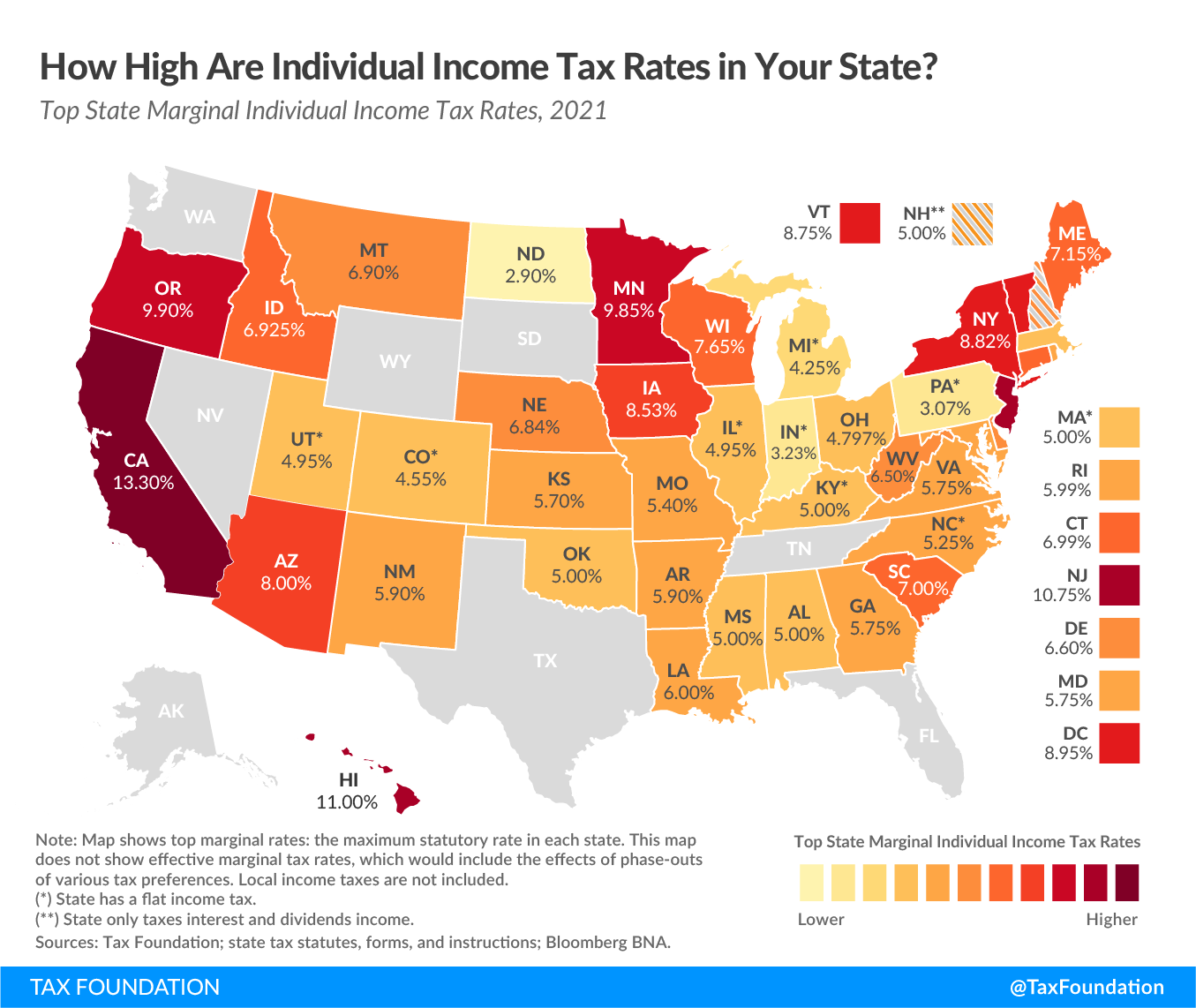

Irs Estimated Tax Schedule 2025 Deni, Benefits to electronic filing include: Ct state income tax rates 2025 for tax years beginning on or after january 1, 2025, the connecticut income tax rate on the first $10,000 and $20,000 of connecticut income.

State Corporate Tax Rates and Brackets Tax Foundation, Use form ct‑1040es, estimated connecticut income tax payment coupon for individuals, to make estimated connecticut income tax payments for 2025 by mail. The budget is said to include the largest income tax cut in connecticut history.

Connecticut 2025 Tax Tables Raf Abigale, The due dates for the estimated tax payments for the year 2025 are as follows: Connecticut governor ned lamont has announced that three income tax measures will take effect at the start of 2025, including reduced income tax rates,.

Enhancements to the child tax credit: Benefits to electronic filing include:

The case for a tax swap by Milan Singh Slow Boring, The house passed the tax relief for american families and workers act of 2025, introducing. On june 12, 2023, connecticut gov.